Come Friday, all being well, South Africa will experience 100 days without load shedding. With this, the business environment has improved meaningfully compared to last year, says independent economist Elize Kruger.

The improvement in the supply of electricity has had a positive influence on production in the economy as well as companies’ ability to pay better salary increases in 2024, she says.

ADVERTISEMENT

CONTINUE READING BELOW

Read: Power cuts have hit SAs labour market hard …

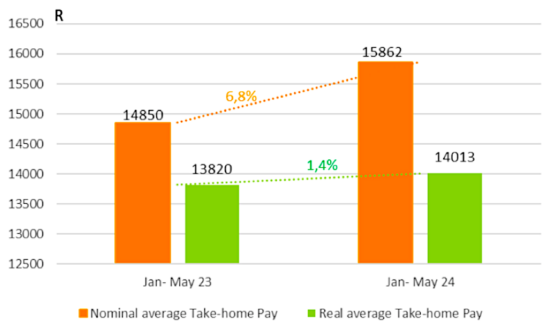

A comparison between the average nominal BankservAfrica Take-Home Pay Index for the five months to May 2024 and the same five-month period in 2023 reveals a 6.8% increase and, in real terms, an increase of 1.4%.

Nominal vs real take-home pay (average, year to date)

Kruger says confidence levels are also slowly by surely creeping higher.

The RMB/BER Business Confidence Index increased from 30 index points in the first quarter of 2024 to 35 index points in Q2 – the highest level since the first quarter of last year.

Read: How business has helped pull SA back from the brink

In response to the latest reprieve on load shedding, says Kruger, the South African Reserve Bank (Sarb) has reduced its assumption on the number of load shedding days in 2024 from 200 days to 180, where a day is 24 hours of load shedding and not any calendar day with load shedding.

“The projected cost to GDP from load shedding in 2024 has also been revised down,” she adds – to 0.5 percentage points versus two percentage points in 2023 and fading to 0.2 percentage points for 2025 and 0.04 for 2026 (percentage points that real GDP would have been higher in the absence of any load shedding).

“My forecast for real GDP growth in 2024 is at 1%, versus 0.7% in 2023.”

Kusile Unit 5

Kruger’s views come as Eskom has officially added another 800MW of generation capacity to the grid.

The utility announced on Sunday (30 June) that Unit 5 at Kusile Power Station has reached commercial operation. While it has been online since December, it was still in a test phase and its power generation was intermittent.

Having successfully completed the necessary tests, the unit has now been officially handed over to Eskom’s generation team, ready for consistent operation.

This is a significant addition to Eskom’s installed generation capacity of 48 186MW.

Eskom System Operator GM Isabel Fick says apart from the additional capacity, Kusile Unit 5 will also contribute to the stability of the grid.

This is part of the 2 500MW Eskom hopes to add before the end of 2024, says Eskom CEO Dan Marokane. The utility expects to return to service another 800MW unit at Medupi and a 1 000MW unit at Koeberg.

Listen/read: SA business and Eskom on track to end load shedding permanently

In addition, Eskom has succeeded in keeping the level of unplanned breakdowns of its service below 30% for eight consecutive weeks. The average for the year to date is 28.95%, an improvement compared to 33.08% in 2023.

The latest weekly average energy availability factor is now at 62.28%, a huge improvement compared to the 54.69% average for the whole of 2023.

ADVERTISEMENT:

CONTINUE READING BELOW

Outlook

The load shedding outlook is also much improved.

Eskom’s 52-week outlook, on the assumption of 16 200MW of capacity having broken down unexpectedly, provides for only 12 weeks of load shedding at levels higher than Stage 2.

In reality these unplanned outages are currently below 12 000MW. If maintained, and with the additional generation capacity in mind, chances of load shedding seem to be dimming.

As the efficiency of Eskom’s generation plant improves, operations should also run in a more cost-effective manner.

For example, in the 2020 financial year, with trips increasing to 711 (from 414 the previous year), Eskom’s use of start-up oil increased by 130%. This resulted in an additional cost of R2.2 billion.

Eskom explains that heavy fuel oil is used to start up and shut down coal-fired power stations. The number of starts required depends on the number of outages – either planned or unplanned – and the number of trips at the units of a station.

Coal

Coal producer Exxaro states that its coal production and sales volumes in the first half of the 2024 financial year are expected to reduce by 14% and 12% respectively “mainly due to the reduced demand from Eskom at Grootegeluk, based on their latest internal plan”.

Grootegeluk supplies Eskom’s Medupi and Matimba power stations near Lephalale in Limpopo.

Exxaro’s head of minerals, Kgabi Masia, however ascribed this partly to trouble with the feeding lines, such as the conveyor belt, to Medupi.

Listen to Jimmy Moyaha’s interview with Exxaro financial director Riaan Koppeschaar in this SAfm Market Update with Moneyweb podcast:

You can also listen to this podcast on iono.fm here.

Post a Comment